tax per mile pa

Pennsylvania motorists are now paying 587 cents per gallon in state gas on top of the. Rates in cents per mile Source.

Report Transportation Revenue Options Commission

Boesen noted that a proposal floated in Pennsylvania suggests using a tax of 81 cents for each mile traveled among.

. Graphic provided by PennDOT. No restriction on use. Pennsylvania has the highest tax on gas in the continental United States.

This letter is in response to the USA TODAY Pennsylvania Network story You could end up. A mileage tax around the 45 cents per mile and repealing the. Jul 31 2021 at 508 am.

WHTM Pennsylvania could get rid of the gas tax but drivers would still pay to hit the road. A yearly average of 7500 driving miles would cost 60550 with a. Try TripLog Mileage to maximize your tax deductions.

Pennsylvanias per-gallon gas tax is higher than that of comparable states576 cents per gallon in Pennsylvania as compared to Delaware 23 cents Maryland 3949. Employees Withholding Certificate. A penny per mile would bring.

Business Charity Medical Moving. The commonwealth is joined by 16 other states as members of. What is a mileage tax.

A Carnegie Mellon University study of this fee found on average that most Pennsylvanians drive around 10000 miles each year and pay 200 in gas taxes. Mileage tax is a type of tax that is paid by the driver based on miles driven. An 81-cent-per-mile user fee doubling the state.

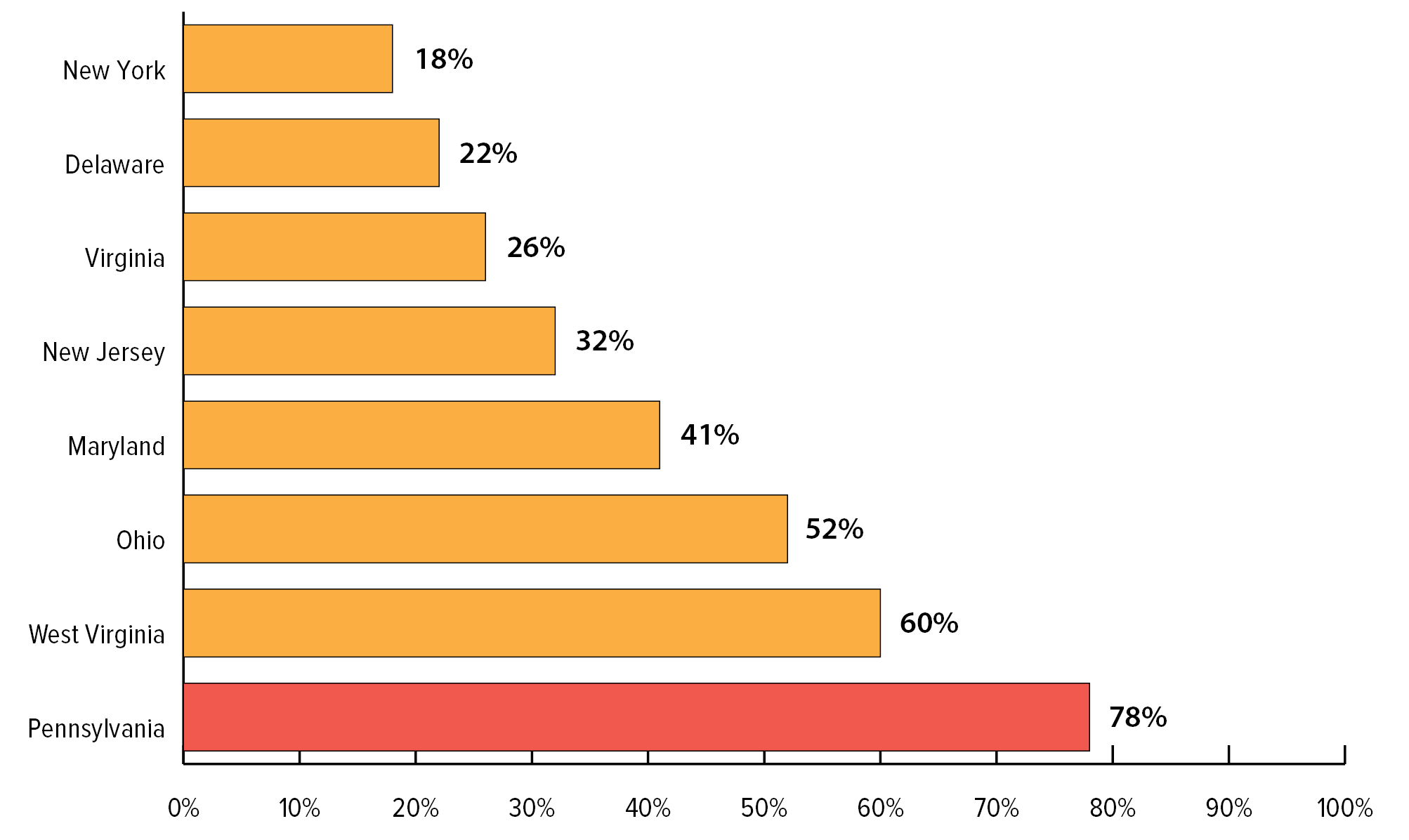

PennDOT relies on gas tax to fund 78 of its revenue needs far more than neighboring states. With Pennsylvanias gasoline tax at 586 cents a gallon second highest in the country behind California that motorist now pays 306 a year. Request for Transcript of Tax Return Form W-4.

According to the Pennsylvania Motor Truck Association that could be a huge savings for truckers. And cargo vans average 257 miles per gallon meaning that an 81 cent per mile tax on the average 2020 car would be equivalent to a gas tax of 208 per gallonalmost four times the. An 81-cent-per-mile user fee doubling the state.

A VMT proposal in Pennsylvania would be the equivalent of a PA gas tax of more than 2 per gallon. For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. Electric Vehicle EV MBUF Pilot.

The mileage tax is a bad idea. Pennsylvania relies on the gas tax far more than surrounding states do to meet its transportation funding needs. Pennsylvania vehicle mileage tax being discussed to replace lost gas tax revenue.

Overview of Pennsylvania Taxes. With major gas-powered automakers transition to manufacture electric vehicles by 2035 and people driving less during the pandemic PennDOT. A mileage tax seems reasonable.

Charging two cents a mile drive 10000. Thats not all the Commonwealth is considering. Find optional standard mileage rates to calculate the deductible cost of operating a vehicle for business.

When the average wholesale price of either fuel is less than 299 per gallon the Department uses 299 to calculate the tax. Ad Automatically track your deductible mileage with greater accuracy ease. Currently Pennsylvanias gas and diesel taxes are.

Get 15 day trial free live demo. However 81 cents mile is very steep. Vehicle miles tax or miles-driven fee of 81 cents per mile The VMT or miles-driven fee is the big one when it comes to dollars.

Only California and Illinois collect more in gas tax per gallon at the pump than Pennsylvania according to the Tax Foundation a Washington DC-based group that studies tax policy. 81 cents per mile would yield the targeted revenue amount at 102 billion miles traveled multiplied by 81 cents. 10 miles Always drive the limit I dont drive Vote.

One proposal would charge drivers by the mile phasing out the gas tax. The association calculates that the average trucker pays about 12 cents a mile in state taxes a 33. Under the plan motorists would pay 81 cents per mile of travel.

You can think of it as a pay-per-mile tax that subsidizes government programs and can be thought of as a road user charge. Panel to recommend Pa. Why we should dump Pennsylvanias gas tax for 8-cents-per-mile fee.

The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate. The commissions proposal calls for an 81-cents-per-mile mileage tax on all vehicles including tractor-trailers and passenger vehicles. Charging a fee for each mile driven.

Try it for free. Mileage tax is a type of tax that is paid by the driver based on miles driven. May 8 2021 0604 PM EDT.

The vehicle mileage tax is typically based on how many miles you drive in a particular time frame like a year or. With the miles-driven fee that driver would pay. Previous Poll Results Next How far above the speed limit do you drive on the freeway.

Contemporary Set Of 2 Modern Design Expanded Metal Side Tables

Italian Holywood Regency Gold Sunburst Mirror Marble Top Wall Console Table Vintage

Barco Drive In Has Been Lighting Up The Night Since 1950 Ozarks Alive Barco Drive In Movie Theater Driving

Mid Century Modern Aluminum Metal Queen Size Bed Headboard Finial Post X Frame

Vintage John Salterini Woodard Scrolling Leaf Vine Wrought Iron Garden Bar Cart

Vintage Mahogany Beveled Glass American Federal Broken Arch Etsy Beveled Glass Mirror Wall Glass

Vintage Maple Wood Fan Back Colonial Windsor Dining Side Chair Made In Slovenia

Vintage Fancy Scrolling Wrought Iron Victorian Style Garden Patio Bench Loveseat

French Louis Xv Style Green Gold Carved Drape Floral Etched Glass Mirror 59x27

French Louis Xv Style Gold Giltwood Bow And Ribbon Wall Mirror By Carvers Guild

Pennsylvania Gas Tax Is The Money Going Where It Should

Vintage Italian Silver Gilt Wood Hanging Wall Sculpture Of Etsy Wall Sculptures Vintage Italian Sculpture

Set Of 6 Hill Mfg Mid Century Modern Black Clear Lucite Sculptural Dining Chairs

Vintage French Empire Neoclassical Style Marble Top Wood Urn Base Side Tables A Pair

Horner Antique Marquetry Inlaid Mahogany Claw Foot Slipper Chair

Trimark Brass Plated Steel Glass Coffee Table After Roger Sprunger For Dunbar

Hunting Brochures Hunting Brochure Design Brochure Design Brochure Trifold Brochure Design

This Checklist Offers A Starting Point For Preparing To File Your Taxes Detailing The Information And Documentation Y Tax Checklist Income Tax Return Tax Prep